The Retirements Benefits Authority (RBA) is seeking to strengthen legal and regulatory frameworks to ensure all employers in Kenya remit their employees’ pension deductions in a timely manner.

This comes on the backdrop of a rise in unremitted pension savings which has risen to Ksh 50 billion by the close of the 2023/24 financial year in June this year according to the authority.

According to RBA Chief Executive Officer Charles Machira, the public universities and state corporations are the biggest holders of unremitted pensions hence there is need to streamline laws governing the retirement benefits sector.

“We need to strengthen the regulatory framework to ensure that those who are not remitting contributions on time particularly the public sector that we take a remedial action to cure that challenge,” said Charles Machira, RBA Chief Executive Officer.

Among the laws RBA targets to be harmonized included Retirement Benefits Act, National Social Security Fund Act, Pensions Act and Income Tax Act.

Despite the Retirement Benefits Act requiring employers to remit pension deductions with 15 days, public institutions have fallen behind in remitting the deductions, a factor that has affected public sector retirees.

“Over 95pc of these unremitted funds are owed by public sector schemes. There is growing concern over the debts owned by public universities, county governments and some state corporations – Nelson Havi Chairman, RBA.

Public universities for instance have not remitted employees’ pension deductions amounting to Ksh 26 billion.

This is being blamed on reduced capitation for universities as well as the collapsing of the parallel programmes in 2015 which has eroded financial position of the institutions.

“Moi University through the parallel programme we were getting Ksh 4 billion every year. When that programme collapsed we lost Ksh 4 billion without affecting the total wage bill. When we closed those campuses, the employees were retained, operational costs were retained to date,” said Dr. Humphrey Njunguna, Moi University Council chairman.

The unremitted pension deductions running into billions of shillings by county governments has also been blamed on the transition from former local authorities which the devolved units were forced to inherit.

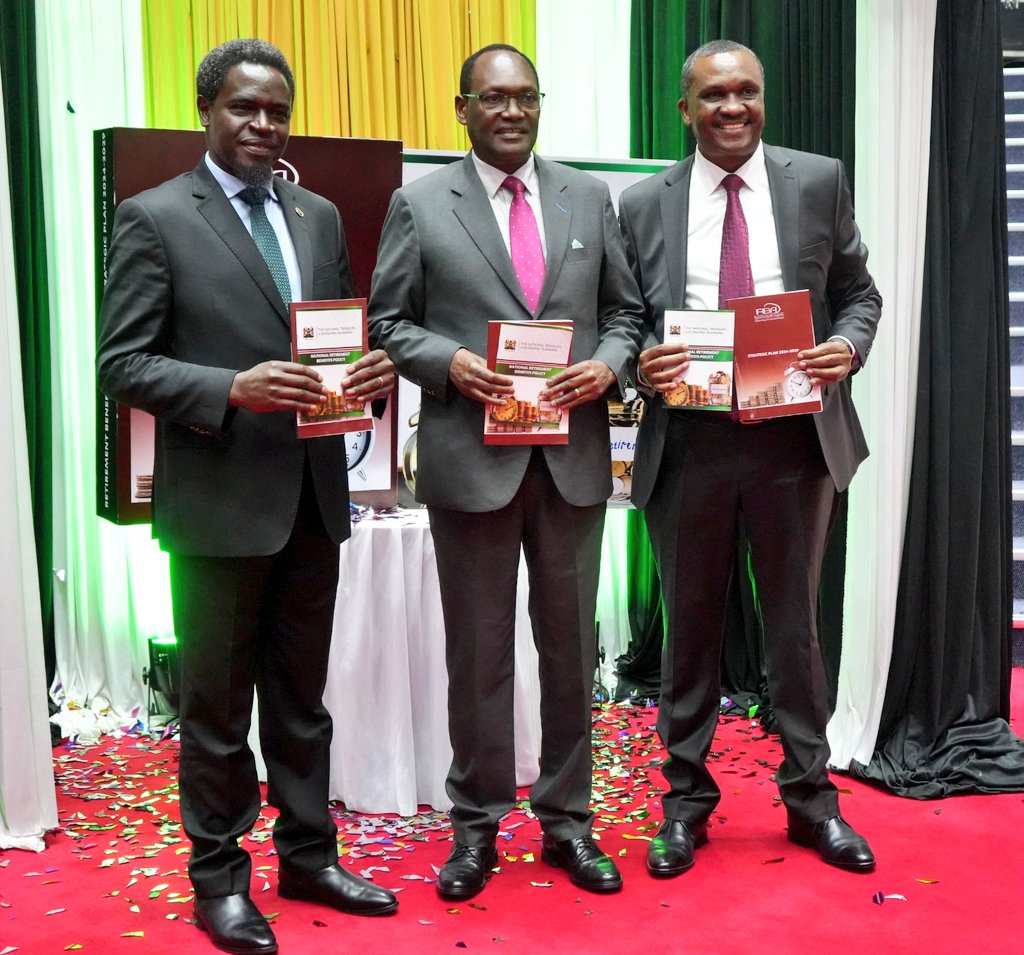

With the launch of the RBA Strategic Plan 2025-2029 and the National Retirement Benefits Policy, RBA is seeking to ensure pensions are deducted when exchequer releases funds for salaries.

“We are in full engagement with the National Treasury with the view of ensuring that the disbursement of money from the exchequer to the extent that it has salaries and pension contribution go direct through an integration which is basically the payroll. The challenge we are having is indiscipline on the part of those employers,” added Machira.

Speaking during the launch of the documents, National Treasury challenged the pension sector to explore additional innovative asset classes and adopt portability of pension schemes not just within Kenya, but also across the border.

“We are mostly in the traditional asset class most of which is in government securities. We have this aspiration to run a balanced budget. When we succeed, the opportunity to invest in government paper might be limited. So it’s good to also think of other asset classes,” said Kiptoo.

Through the RBA Strategic Plan 2025-2029 and the National Retirement Benefits Policy, RBA is targeting to grow pension Assets Under Management from the current Ksh 1.9 trillion to Ksh 3.2 trillion within five years. This will move pension coverage ration from the current 26pc to 34pc during the period.