Micro, Small and Medium Enterprises run by youth and women are expected to access critical funding and resources to help them scale their businesses through the Investing in Young Businesses in Africa (IYBA) initiative.

The funding by the European Investment Bank (EIB) in partnership with the KCB Bank Kenya targets to accelerate the growth of startups and young entrepreneurs by providing access to finance, mentorship, and technical assistance.

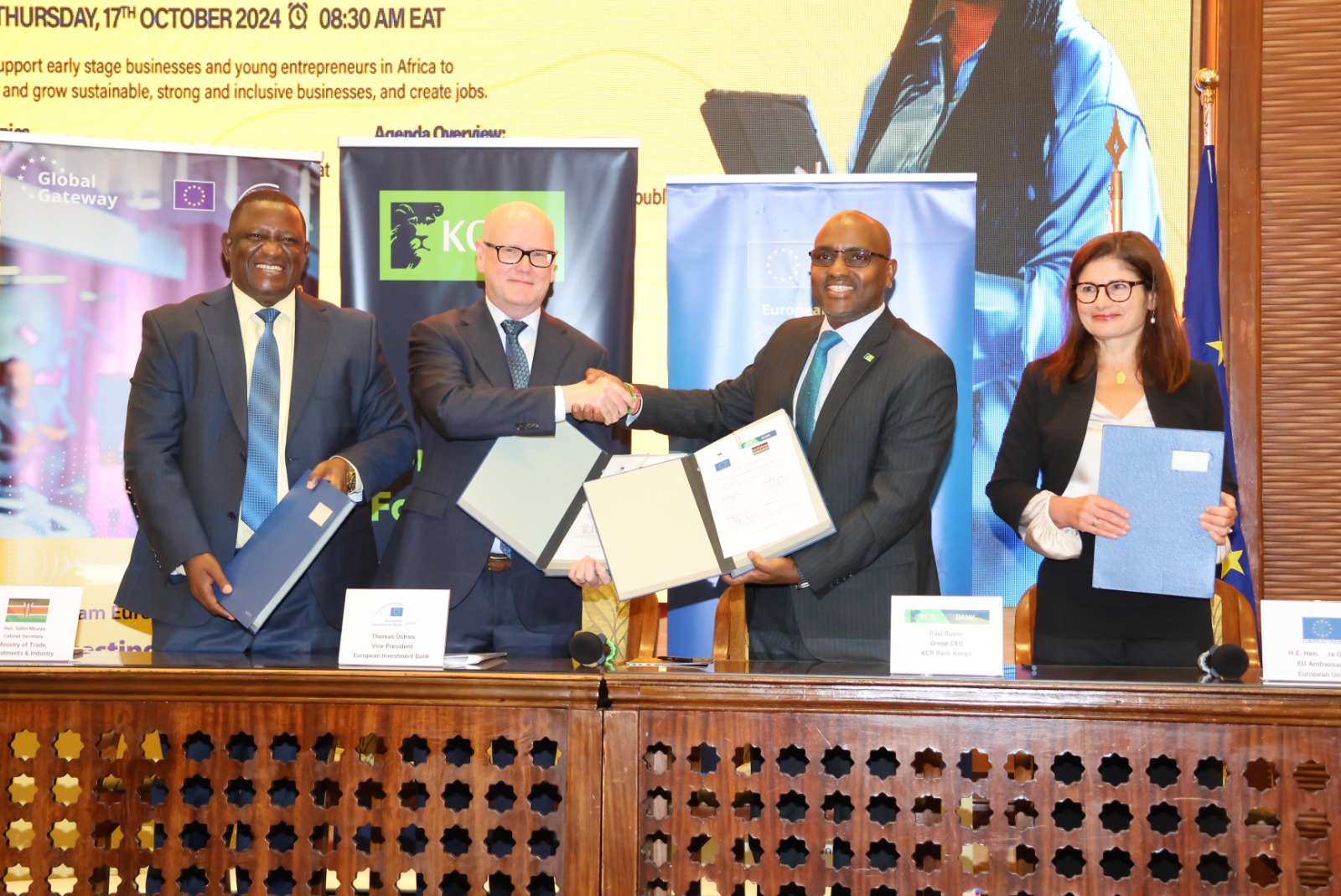

Speaking during the signing of the agreement, Investments, Trade, and Industry Cabinet Secretary Salim Mvurya emphasized the pivotal role of MSMEs play in Kenya’s economy as the sector contributes 33pc to the country’s economy.

“This credit line is a vital lifeline for early-stage businesses, empowering our youth and women to embark on self-sustaining ventures,” said CS Mvurya.

The initiative will address access to finance which remains a significant challenge for many MSMEs, often stunting their growth potential.

The new credit line is designed to alleviate these barriers by offering essential capital, technical expertise, and partnerships with local financial institutions. This comprehensive approach will create diverse funding opportunities, enabling MSMEs to recover, scale, and contribute to sustainable economic growth.

“By developing customized products and services, MSMEs can meet both local and global market demands, thereby retaining wealth within our communities,” added Mvurya.

CS Mvurya also urged women and youth to take advantage of this initiative as it is crucial for economic revitalization.

The ministry is currently undertaking reforms to enhance the business and investment climate in Kenya by focusing on industrial subcontracting strategy to stimulate sustainable development by facilitating technology transfer, improving product quality, and enhancing market access for MSMEs.