The National Democratic Institute (NDI) has criticised the 2024 Budget Statement tabled in Parliament last week for proposing measures that increase taxation.

In the budget policy, the Public Finance table showed that taxation will increase by Sh324 billion between the current and the next financial year which begs the question of where the extra 324 billion will come from.

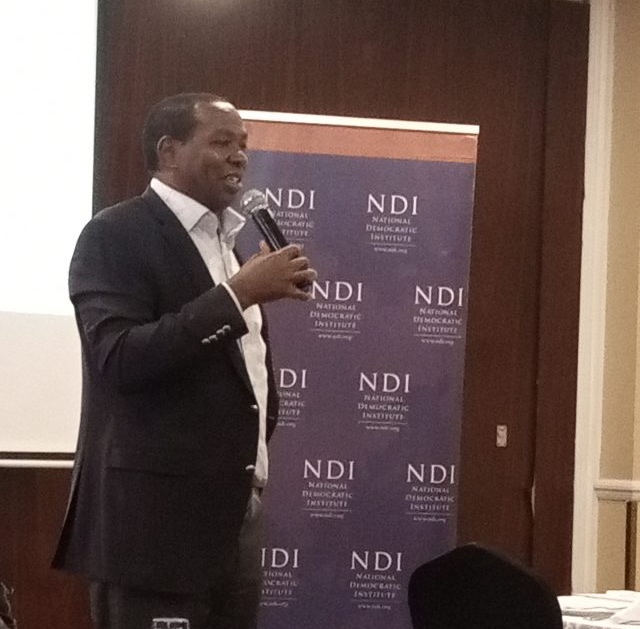

Speaking at a hotel in Nairobi, Mr Ndiritu Muriithi, an Economist and the former Governor of Laikipia County, said that the new budget policy is 44 percent higher than what was there 18 months ago in taxes.

“There are a couple of interesting proposals that are mentioned but not developed such as the agricultural transformation and inclusive growth,” stated Muriithi.

He termed the title of the proposal in agriculture as very promising but added it only focuses on fertilizer subsidy and 17 warehouses for the maize crop.

Further, the proposal according to Muriithi then promises the mainstreaming of nine value chains and that the Government will align all policies under the agricultural sector towards increasing food production, boosting smallholder production, and reducing the cost of food.

“You can’t focus only on maize produce and subsidizing fertilizers. Where is the transformation? Where is the inclusive growth of the jobless youth while welfare measures are getting worse?” questioned Muriithi.

He also noted that in the policy statement, there is also an introduction of Value Added Tax (VAT) on education and insurance services, an added introduction of motor vehicle circulation tax payable annually by motor vehicle owners, and a review on excise tax regime for alcoholic beverages to base taxation on alcoholic content.

“There is expected to be a Sh967 billion growth in expenditure between the financial year 2022/23 through to 2024/25. Is it realistic that in this economy it is possible to procure an additional Sh900 billion in taxes in 18 months?” Muriithi further questioned.

Stating that it is not possible to tax yourself to prosperity, Muriithi lamented that the government in its continued borrowing will result in interest rates remaining high as lending rates are expected to also remain high throughout 2024.

In the current trajectory, according to Muriithi, taxes are planned to double from Sh2.36 trillion in the year 2022/23 to Sh4.98 trillion in the year 2027/28. This comprises Sh4.31 trillion in direct taxes and Sh673 billion in what is paid for services whereas the stock of debt will increase by Sh3.94 trillion which is about 40 percent.

“What happens to the recurrent budget? Many jobs are already redundant,” observed Muriithi, citing his trip to Laikipia County where he said there are 30 telephone operators in a county in which over 250 employees did not have any certificate and even though the County paid for training for some of them, most were declared redundant.

Also speaking at the event, NDI Country Director Dennis Omondi posited that the Budget Policy Statement is like a floor plan where the architect is the Treasury, and citizens are the owners of the building and the founders of the plan.

He alluded that the citizen knows the depth of their pockets, and bringing down the building is more difficult than reducing the number of rooms from the start.

“We may be giving money to departments that don’t need it like the National Youth Service (NYS); in 2015 it received Sh5 billion but in 2017 received Sh25 billion. They did not need that much money but it is apparent corruption was taking place,” said Omondi.

Parliament has 14 days to discuss the report on the Budget Policy Statement and adopt it with or without amendments.